Newsroom

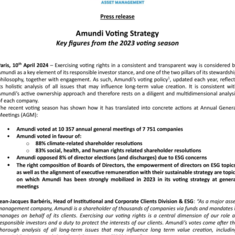

Amundi Voting Strategy 2024: key figures from the 2023 voting season

April 11, 2024

Exercising voting rights in a consistent and transparent way is considered by Amundi as a key element of its responsible investor stance, and one of the two pillars of its stewardship philosophy, together with engagement. As such, Amundi’s voting policy[1], updated each year, reflects its holistic analysis of all issues that may influence long-term value creation. It is consistent with Amundi’s active ownership approach and therefore rests on a diligent and multidimensional analysis of each company.

The recent voting season has shown how it has translated into concrete actions at Annual General Meetings (AGM):

- Amundi voted at 10 357 annual general meetings of 7 751 companies

- Amundi voted in favour of:

- 88% climate-related shareholder resolutions

- 83% social, health, and human rights related shareholder resolutions

- Amundi opposed 8% of director elections (and discharges) due to ESG concerns

- The right composition of Boards of Directors, the empowerment of directors on ESG topics, as well as the alignment of executive remuneration with their sustainable strategy are topics on which Amundi has been strongly mobilized in 2023 in its voting strategy at general meetings

Jean-Jacques Barbéris, Head of Institutional and Corporate Clients Division & ESG: “As a major asset management company, Amundi is a shareholder of thousands of companies via funds and mandates it manages on behalf of its clients. Exercising our voting rights is a central dimension of our role as responsible investors and a duty to protect the interests of our clients. Amundi’s votes come after the thorough analysis of all long-term issues that may influence long term value creation, including material Environmental, Social and Governance (ESG) issues.”

Caroline Le Meaux, Global Head of Research, Engagement and Voting: “Together with engagement, exercising our voting rights is a key pillar of our stewardship activity and deploy Amundi’s responsible investment agenda. Amundi has a clear approach, which is consistent, ambitious and pragmatic, searching for the balance path towards a sustainable low carbon economy that create value for our clients.”

Amundi intends to fully exercise its responsibility as an investor by voting at all general meetings, whenever it is operationally possible, according to its Voting Policy. Casting a vote every year at more than 10,000 general meetings allows Amundi to share its views with investee companies and hold them accountable on their ESG practices.

Evolution in the structure of our voting report

In 2024, Amundi has increased its transparency regarding the integration in its voting approach of environmental and social considerations, which are now outlined in a separate chapter in the Voting Policy titled “Environmental and Social Issues”.

In compliance with the EU Shareholder Rights Directive II, Amundi also provides a complete list of significant votes and the rationales of the voting decisions in a separate appendix of the 2023 Voting Report. Amundi identifies as significant votes:

- Shareholder proposals related to sustainability topics (environment, climate, labour rights, human rights, etc.);

- “Say on Climate” proposals

Access to the full Amundi Voting report 2024 here

Footnotes

- ^ [1] For additional information on the content and scope of application of the Amundi’s voting policy, click here

Experts

Before joining Amundi in 2016, Jean-Jacques served the President of the French Republic since 2013 where he was Economic and Financial Affairs Advisor. Prior to that, he was a member of the ca[...]

Read moreCaroline Le Meaux joined Amundi on July 1st, 2019 and takes the responsibility of the ESG Research, Engagement and Voting team. She was previously head of the long-[...]

Read moreContact

Danae Quek

UK - International Press Relations

About Amundi

About Amundi

Amundi, the leading European asset manager, ranking among the top 10 global players[1], offers its 100 million clients - retail, institutional and corporate - a complete range of savings and investment solutions in active and passive management, in traditional or real assets. This offering is enhanced with IT tools and services to cover the entire savings value chain. A subsidiary of the Crédit Agricole group and listed on the stock exchange, Amundi currently manages more than €2.3 trillion of assets[2].

With its six international investment hubs[3], financial and extra-financial research capabilities and long-standing commitment to responsible investment, Amundi is a key player in the asset management landscape.

Amundi clients benefit from the expertise and advice of 5,600 employees in 35 countries.

Amundi, a trusted partner, working every day in the interest of its clients and society

Footnotes

- ^ [1] Source: IPE "Top 500 Asset Managers" published in June 2024 based on assets under management as of 31/12/2023

- ^ [2] Amundi data as at 31/03/2025

- ^ [3] Paris, London, Dublin, Milan, Tokyo and San Antonio (via our strategic partnership with Victory Capital)

Footnotes