Newsroom

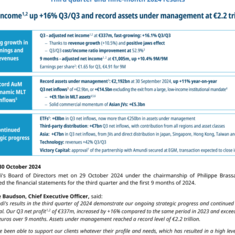

Net income[1],[2] up +16% Q3/Q3 and record assets under management at €2.2 trillion

|

Strong growth in earnings and revenues |

|

Q3 - adjusted net income1,2 at €337m, fast-growing: +16.1% Q3/Q3

9 months - adjusted net income1, 2 at €1,005m, up +10.4% 9M/9M Earnings per share2: €1.65 for Q3, €4.91 for 9M |

|

|

|

|

|

Record AuM |

|

Record assets under management[3]: €2,192bn at 30 September 2024, up +11% year-on-year Q3 net inflows3 of +€2.9bn, or +€14.5bn excluding the exit from a large, low-income institutional mandate[4] |

|

|

|

|

|

Continued strategic progress |

|

ETFs6: +€8bn in Q3 net inflows, now more than €250bn in assets under management Third-party distribution: +€7bn Q3 net inflows, with contribution from all regions and asset classes Asia: +€7bn in Q3 net inflows, from JVs and direct distribution in Japan, Singapore, Hong Kong, Taiwan and China Technology: revenues +42% Q3/Q3 Victory Capital: approval[7] of the partnership with Amundi secured at EGM, transaction expected to close in Q1 2025 |

Amundi's Board of Directors met on 29 October 2024 under the chairmanship of Philippe Brassac, and reviewed the financial statements for the third quarter and the first 9 months of 2024.

Valérie Baudson, Chief Executive Officer, said:

« Amundi's results in the third quarter of 2024 demonstrate our ongoing strategic progress and continued growth potential. Our Q3 net profit1,2 of €337m, increased by +16% compared to the same period in 2023 and exceeded one billion euros over 9 months. Assets under management reached a record level of €2.2 trillion.

We have been able to support our clients whatever their profile and needs, which has resulted in a high level of net inflows in our strategic development areas, namely Asia, Third-Party Distributors, and ETFs.

By putting clients at the heart of our strategy and by continuing to develop the areas of expertise that primarily seek to meet their needs, we are ideally positioned to seize growth opportunities in the savings industry. »

Footnotes

- ^ Net income Group share

- ^ Adjusted data: excluding amortisation of intangible assets relating to distribution and client contracts as well as other non-cash charges relating to the acquisition of Alpha Associates recorded in net financial income (see note p. 11)

- ^ Assets under management and flows including assets under advisory, marketed assets and funds of funds, and taking into account 100% of Asian JV’s assets and flows; for Wafa Gestion in Morocco, they are reported in proportion to Amundi's holding in the capital of the JV

- ^ As announced at the time of the publication of the Q2 results, exit in Q3 from a large low-income mandate (€11.6 billion) with a European insurer, in multi-asset; including this exit, net inflows were positive by +€2.9bn in Q3 and +€35bn over 9 months

- ^ Medium-Long Term Assets

- ^ Excluding JVs

- ^ Extraordinary General Meeting of Shareholders of Victory Capital, held on 11 October 2024

Expert

Valérie Baudson

Member of Executive Committee of Crédit Agricole S.A., Chief Executive Officer of Amundi

Valérie Baudson is Deputy Chief Executive Officer of Crédit Agricole S.A. in charge of the asset management division and a member of the Executive Committee of Crédit Agricole SA since May 202[...]

Read moreAbout Amundi

About Amundi

Amundi, the leading European asset manager, ranking among the top 10 global players[1], offers its 100 million clients - retail, institutional and corporate - a complete range of savings and investment solutions in active and passive management, in traditional or real assets. This offering is enhanced with IT tools and services to cover the entire savings value chain. A subsidiary of the Crédit Agricole group and listed on the stock exchange, Amundi currently manages more than €2.3 trillion of assets[2].

With its six international investment hubs[3], financial and extra-financial research capabilities and long-standing commitment to responsible investment, Amundi is a key player in the asset management landscape.

Amundi clients benefit from the expertise and advice of 5,600 employees in 35 countries.

Amundi, a trusted partner, working every day in the interest of its clients and society

Footnotes

- ^ [1] Source: IPE "Top 500 Asset Managers" published in June 2024 based on assets under management as of 31/12/2023

- ^ [2] Amundi data as at 31/03/2025

- ^ [3] Paris, London, Dublin, Milan, Tokyo and San Antonio (via our strategic partnership with Victory Capital)

Footnotes