Newsroom

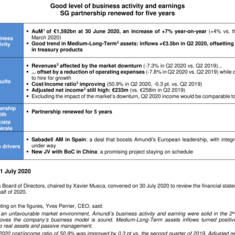

Good level of business activity and earnings

SG partnership renewed for five years

|

Business activity |

|

|

Results |

|

|

Partnership with Société Générale |

|

|

Growth drivers |

|

Amundi’s Board of Directors, chaired by Xavier Musca, convened on 30 July 2020 to review the financial statements for the first half of 2020.

Commenting on the figures, Yves Perrier, CEO, said:

“Despite an unfavourable market environment, Amundi’s business activity and earning were solid in the 2nd quarter, which proves the company’s business model is sound. Medium-Long-Term assets inflows turned positive, thanks notably to real assets and passive management.

The Q2 2020 cost/income ratio of 50.9% was improved by 0.3 pt vs. the second quarter of 2019. Adjusted net income amounted to €233m. Excluding the impact on revenues of the decrease of average financial markets levels, this net income would be comparable to that of Q2 2019.

The partnership with Société Générale has been renewed in all its aspects, which strengthens Amundi's position as a reference partner of the Retail networks in Europe

The growth drivers initiated at the start of the year are taking shape in line with our stated objectives:

- The acquisition of Sabadell AM, making Amundi the 4th player in Spain, was finalized at the end June, and the expected synergies have been revaluated.

- The implementation of the joint-venture with BOC in China continues in line with the envisaged plan, with a launch of operations planned in Q4 2020

Lastly, Amundi continued to implement its ESG plan announced in October 2018, stepping up responsible investing initiatives”.

Footnotes

- ^ Assets under management and net inflows (excluding Sabadell AM) include assets under advisory and assets marketed and take into account 100% of assets under management and net inflows on the Asian JVs. For Wafa in Morocco, assets are reported on a proportional consolidation basis.

- ^ Medium-Long-Term Assets: excluding -€4.3bn in treasury products in Q2 2020.

- ^ Adjusted data: excluding amortisation of distribution contracts; See page 10 for definitions and methods.

About Amundi

About Amundi

Amundi, the leading European asset manager, ranking among the top 10 global players[1], offers its 100 million clients - retail, institutional and corporate - a complete range of savings and investment solutions in active and passive management, in traditional or real assets. This offering is enhanced with IT tools and services to cover the entire savings value chain. A subsidiary of the Crédit Agricole group and listed on the stock exchange, Amundi currently manages more than €2.3 trillion of assets[2].

With its six international investment hubs[3], financial and extra-financial research capabilities and long-standing commitment to responsible investment, Amundi is a key player in the asset management landscape.

Amundi clients benefit from the expertise and advice of 5,600 employees in 35 countries.

Amundi, a trusted partner, working every day in the interest of its clients and society

Footnotes

- ^ [1] Source: IPE "Top 500 Asset Managers" published in June 2024 based on assets under management as of 31/12/2023

- ^ [2] Amundi data as at 31/03/2025

- ^ [3] Paris, London, Dublin, Milan, Tokyo and San Antonio (via our strategic partnership with Victory Capital)

Footnotes