Newsroom

A high net income[1],[2] at €300 million

|

Results |

|

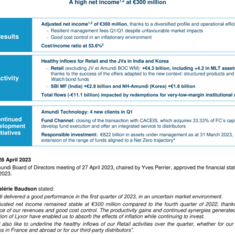

Adjusted net income1,2 of €300 million, thanks to a diversified profile and operational efficiency

Cost/income ratio at 53.6%2 |

|

|

|

|

|

Activity |

|

Healthy inflows for Retail and the JVs in India and Korea

Total flows (-€11.1 billion) impacted by redemptions for very-low-margin institutional assets |

|

|

|

|

|

Continued development initiatives |

|

Amundi Technology: 4 new clients in Q1 Fund Channel: closing of the transaction with CACEIS, which acquires 33.33% of FC’s capital to develop fund execution and offer an integrated service to distributors Responsible investment: €822 billion in assets under management as at 31 March 2023, extension of the range of funds aligned to a Net Zero trajectory[4] |

The Amundi Board of Directors meeting of 27 April 2023, chaired by Yves Perrier, approved the financial statements for Q1 2023.

CEO Valérie Baudson stated:

“Amundi delivered a good performance in the first quarter of 2023, in an uncertain market environment.

Our adjusted net income remained stable at €300 million compared to the fourth quarter of 2022, thanks to the resilience of our revenues and good cost control. The productivity gains and continued synergies generated by the integration of Lyxor have enabled us to absorb the effects of inflation while continuing to invest.

I would also like to underline the healthy inflows of our Retail activities over the quarter, whether for our partner networks in France and abroad or for our third-party distributors”.

Footnotes

- ^ [1] Attributable net income

- ^ [2] Adjusted data: excludes amortisation of intangible assets, and in 2022 Lyxor integration costs (see note p. 8)

- ^ [3] MLT: Medium/Long Term

- ^ [4] All Net Zero Ambition passive management funds comply with the EU’s CTB/PAB criteria

Expert

Valérie Baudson

Member of Executive Committee of Crédit Agricole S.A., Chief Executive Officer of Amundi

Valérie Baudson is Deputy Chief Executive Officer of Crédit Agricole S.A. in charge of the asset management division and a member of the Executive Committee of Crédit Agricole SA since May 202[...]

Read moreAbout Amundi

About Amundi

Amundi, the leading European asset manager, ranking among the top 10 global players[1], offers its 100 million clients - retail, institutional and corporate - a complete range of savings and investment solutions in active and passive management, in traditional or real assets. This offering is enhanced with IT tools and services to cover the entire savings value chain. A subsidiary of the Crédit Agricole group and listed on the stock exchange, Amundi currently manages more than €2.3 trillion of assets[2].

With its six international investment hubs[3], financial and extra-financial research capabilities and long-standing commitment to responsible investment, Amundi is a key player in the asset management landscape.

Amundi clients benefit from the expertise and advice of 5,600 employees in 35 countries.

Amundi, a trusted partner, working every day in the interest of its clients and society

Footnotes

- ^ [1] Source: IPE "Top 500 Asset Managers" published in June 2024 based on assets under management as of 31/12/2023

- ^ [2] Amundi data as at 31/03/2025

- ^ [3] Paris, London, Dublin, Milan, Tokyo and San Antonio (via our strategic partnership with Victory Capital)

Footnotes