Newsroom

Net income[1],[2] of €1.2bn and positive inflows of +€7bn

|

2022 |

|

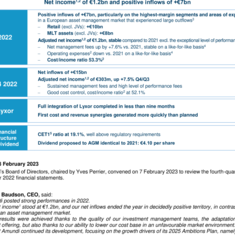

Positive inflows of +€7bn, particularly on the highest-margin segments and areas of expertise, in a European asset management market that experienced large outflows[3]

Adjusted net income1,2 of €1.2bn, stable compared to 2021 excl. the exceptional level of performance fees

|

|

|

|

|

|

Q4 2022 |

|

Net inflows of +€15bn Adjusted net income1,2 of €303m, up +7.5% Q4/Q3

|

|

|

|

|

|

Lyxor |

|

Full integration of Lyxor completed in less than nine months First cost and revenue synergies generated more quickly than planned |

|

|

|

|

|

Financial structure |

|

CET1[5] ratio at 19.1%, well above regulatory requirements Dividend proposed to AGM identical to 2021: €4.10 per share |

Amundi’s Board of Directors, chaired by Yves Perrier, convened on 7 February 2023 to review the fourth-quarter and full-year 2022 financial statements.

Valérie Baudson, CEO, said:

“Amundi posted strong performances in 2022.

Our net income1 stood at €1.2bn, and our net inflows ended the year in decidedly positive territory, in contrast to the European asset management market.

These results were achieved thanks to the quality of our investment management teams, the adaptation of our product offering, but also thanks to our ability to lower our cost base in an unfavourable market environment.

In 2022 Amundi continued its development, focusing on the growth drivers of its 2025 Ambitions Plan, namely in real assets, passive management, technology, services and Asia.

Lastly, the integration of Lyxor was successfully completed in less than nine months. It makes Amundi a European leader in ETFs, with a fully-operational platform, and it is already delivering cost and revenue synergies.

Our agility, growth drivers, diversification, high level of profitability and financial solidity allow us to be confident in Amundi’s value-creating capacity.

We propose to our shareholders a dividend for 2022 stable vs. 2021.”

Footnotes

- ^ [1] Net income, Group share

- ^ [2] Adjusted data: excluding amortisation of the intangible assets, the integration costs related to Lyxor and, in 2021, the impact of Affrancamento (see note on p. 11).

- ^ [3] Source Morningstar, European open-ended funds, cross-border and domestic

- ^ [4] Constant scope: including Lyxor in 2021

- ^ [5] CET 1: Common Equity Tier 1

Expert

Valérie Baudson

Member of Executive Committee of Crédit Agricole S.A., Chief Executive Officer of Amundi

Valérie Baudson is Deputy Chief Executive Officer of Crédit Agricole S.A. in charge of the asset management division and a member of the Executive Committee of Crédit Agricole SA since May 202[...]

Read moreAbout Amundi

About Amundi

Amundi, the leading European asset manager, ranking among the top 10 global players[1], offers its 100 million clients - retail, institutional and corporate - a complete range of savings and investment solutions in active and passive management, in traditional or real assets. This offering is enhanced with IT tools and services to cover the entire savings value chain. A subsidiary of the Crédit Agricole group and listed on the stock exchange, Amundi currently manages more than €2.3 trillion of assets[2].

With its six international investment hubs[3], financial and extra-financial research capabilities and long-standing commitment to responsible investment, Amundi is a key player in the asset management landscape.

Amundi clients benefit from the expertise and advice of 5,600 employees in 35 countries.

Amundi, a trusted partner, working every day in the interest of its clients and society

Footnotes

- ^ [1] Source: IPE "Top 500 Asset Managers" published in June 2024 based on assets under management as of 31/12/2023

- ^ [2] Amundi data as at 31/03/2025

- ^ [3] Paris, London, Dublin, Milan, Tokyo and San Antonio (via our strategic partnership with Victory Capital)

Footnotes